UK Vape Tax Confirmed For 2026 In Labour Party Budget

It has been a dramatic time for vapers in the UK, as Starmer's Labour government begin ironing out their plans for future legislation. A number of measures previously discussed by the Conservatives under Rishi Sunak regarding tobacco and vaping have re-entered the fray. The latest of which, being the announcement of the very first landmark tax on e-liquids, during Labour's budget reveal (30/10/24). The price hike has been scheduled to be introduced in October 2026.

This news came just days after confirmation that from the 1st of June 2025, it will no longer be legal to buy or sell single-use vape kits in any form. This gave the entire vape industry, including retailers and consumers alike, from the 24th October 2024, until the 1st June 2025 to buy and sell any remaining disposable vape stock they desire.

Below we will explore the nature of the taxation, as well as how it could impact vapers across the UK.

Why Is The UK Introducing A Vape Tax?

Rachel Reeves: "We want to discourage non-smokers & young people from taking up vaping."

The UK vape tax has been closely tied to the debate surrounding disposable vape use amongst under-18s. In fact, it was originally put forward as a part of the original Tobacco and Vapes bill drafted by the former Conservative Government.

The leading theory is that in conjunction with banning disposable vapes, which would remove the easiest vaping product to access and use from youngsters' reach, imposing a levy on vape juice would seek to price-out those that then might turn to refillable vapes instead. Ultimately this system is designed to prevent under-18s and non-smokers from wanting to start vaping.

This earlier proposed tax was more fleshed-out than the Labour equivalent announced yesterday. Previously it was stated that:

"The rates will be £1.00 per 10ml for nicotine free liquids, £2.00 per 10ml on liquids that contain 0.1-10.9 mg nicotine per ml, and £3.00 per 10ml on liquids that contain 11mg or more per ml".

Despite this earlier structure, so-far Labour have simply stated that they will impose a rate of £2.20 per 10ml of e-liquid sold.

A UK-wide consultation period on both the disposable ban and vape tax ran from the 23rd February to the 8th March 2024. The bill was challenged by public and private-sector vaping advocates. They argued that a total ban risked reversing progress made towards the Government's own smoke-free goals, by driving vapers back to cigarettes, while encouraging a black market vape trade. Many also felt it flew in the face of recommendations put forward by the Khan Review in 2023. Which advocated vaping as a method of tobacco harm reduction as one of its 'key pillars' for change. Stating that taxation should be applied to tobacco only to boost funding to Stop Smoking Services.

Ultimately these counter-claims were overturned. Largely due to an overwhelming 77% of consultation respondents being in-favour of the proposals. Leading to the ban and excise duty being pencilled-in for 2025 and formalised in the Tobacco and Vapes bill by March 2024.

When the snap general election was held in July however, all plans involving vaping were shelved. As MPs scrambled to push a handful of legislature through into law, before the dissolution of parliament; with the proposed Tobacco and Vapes bill not making the cut.

In the October 2024 Labour Budget reveal however, Chancellor Rachel Reeves announced that a duty of £2.20 per 10ml would indeed be applied to e-liquids in the UK by October 2026.

The main reasons/goals given for the new vape tax include:

-

To make vaping products less affordable for under 18s

Disposable vapes have been at the heart of a youth vaping crisis in the UK. With thousands of reports of under-18s getting their hands on single-use vapes seen as trendy by peers. The colours and flavours of the devices being pinned as the primary appeal. Widespread reports of children vaping in schools triggered a huge public uproar, forcing the hands of policymakers.

The tax on vapes is intended to price-out under-18s and discourage those who have never vaped or smoked previously from ever starting.

-

Ensuring vaping remains more affordable than smoking

While Labour do intend to make vaping more expensive overall with their new duty, they are also planning on introducing several taxes on traditional tobacco products. According to the Daily Mail:

"According to Treasury figures smokers can expect to pay 54p more for a packet of 20 cigarettes, while 30g of rolling tobacco will have an extra £2.32 added to the price. There will also be a 27p jump per 10g of cigars, a 35p rise for 30g of pipe tobacco and a price increase of 13p for a 6g pack of heating tobacco - a move that will be a bitter pill to swallow for smokers."

When Will The UK Vape Tax Come Into Effect?

The most recent information from the UK government tells us that the vape duty will take effect from the 1st October 2026. That gives vapers like you and retailers like us some time to prepare for the impact. It will undoubtedly have effects on personal budgets and businesses profits alike.

We do not currently know if the decision will evolve into a tiered structure based on nicotine content, as was the original proposition by the former Conservative party. Every vaping brand currently operating in the UK will have to work hard to balance potential price increases against customer budgets. At the same time vapers must begin thinking about how e-liquid becoming more expensive impacts their buying habits.

If you have an EDGE Vaping account for our online vape shop, we encourage you to sign up to our email newsletters. We will make every effort to communicate any future pricing changes as early as possible!

What Products Will The UK Vape Tax Affect?

Currently the 2026 excise duty is set to target vaping liquids exclusively. There has been no mention of anything relating to vape kits, pods or coils. This means the likes of EDGE Core, Elite and bar salts will all be captured within the tax of £2.20 per 10ml.

Brands like Elf Bar, Lost Mary and SKE Crystal, who rely on importing their 10ml bottled vape juice ranges from China, will potentially be hit hardest. As they will face the costs of importation, bonded warehousing and more, in conjunction with the new 22p per ml duty. This means vapers who enjoy Elfliq and Maryliq etc may see their favourites become vastly more expensive. If the brands behind them even choose to continue importing them after the tax.

Thankfully brands like EDGE have more flexibility to adapt to the tax. Being made in the UK, not only means we offer quality you can trust, but also means we do not have to factor in expensive import duties on top of the new tax in 2026.

How Much Will E-Liquid Cost In The UK After The Vape Tax?

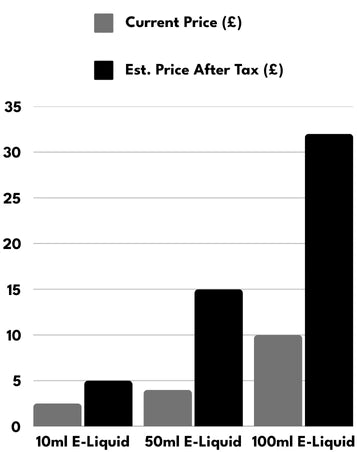

While it is hard to say exactly how different brands will choose to factor the new duty into their e-liquid pricing, we can make a face-value estimate based on the current information from the Labour Budget.

Brands like ours that have always focussed on value for money, will likely see a smaller increase in price than the likes of Elf Bar or Lost Mary, whose 10ml products start at circa £4.99. The latter could see their e-liquids jump to as much as £7.19 for a single 10ml bottle. Shortfill e-liquids in particular will be hit hardest, as of course they are the largest volume examples of e-liquids on the market, and so will have the most tax applied.

How Will Best-Selling Vape Brands Respond To The Tax?

As with any news of tax increases, the revelation by Rachel Reeves has generated plenty of backlash. Unsurprisingly big tobacco companies are in favour of the tax, likely seeing it as a leveller vs the rising duties tobacco products continue to face. While this is speculation, it is fair to assume anything that might drive vapers back to cigarettes will ultimately be seen as a boon by those who control their purse-strings.

For vaping advocates and businesses however opinions have been mixed to negative. Quoting from the Daily Mail:

What Can Vapers Do To Get Ahead Of The UK E-Liquid Tax?

As the date for the new duty on e-liquids is set for 2026, there really isn't much you need to do in response right now. There is no need for panic buying - we've only just heard the news ourselves and so nothing is going to change quickly.

Eventually, it's true that there could be price increases to bottles of e-liquid. Although at EDGE we will do everything we can to mitigate the impact to our customers, it is simply to early to say how future pricing structures will look.

All vapers loyal to particular brands should keep their eyes peeled in the coming weeks and months for updates about any changes the tax may bring about. Signing up to email newsletters is a great way to keep on top of the latest news.

EDGE Nic Salts

View allUK Vaping Tax FAQs

To ensure you have the best understanding of the e-liquid duty's implications as a vaper, we have explained some extra FAQs you may ask:

Will The New Tax Make Vaping As Expensive As Smoking?

Will The New Tax Make Vaping As Expensive As Smoking?

No it won't. Alongside the tax on vape juice, the government are increasing the tobacco excise duty.

Will There Be A Tax On Vape Kits?

Will There Be A Tax On Vape Kits?

As it stands, no. Whether the government looks to change this in the future, we cannot be sure. For now though, it is just eliquids that are will be taxed.

Who Benefits From The Vape Tax?

Who Benefits From The Vape Tax?

There are 3 main winners. The government, the NHS and under-18s. The revenue raised can be distributed by parliament to help fund public services, including the NHS. The reduced accessibility for the youth of today is no bad thing either.